Featured Municipal Bond Issue, Week of December 11, 2017: The City of Philadelphia Airport Revenue and Refunding Bonds – $721 Million

This week’s featured bond comes from the State of Pennsylvania. The City of Philadelphia is issuing $721 million in airport revenue bonds the week of December 11, 2017. These revenue bonds are being issued as two separate series. Series 2017A is $141 million in revenue bonds treated as traditional government bonds, while Series 2017B is $580 million in revenue bonds treated as qualified airport private activity bonds. Both series are considered to be interest-exempt from federal income taxes, but while interest on the Series 2017A bonds is not treated as an item of tax preference for purposes of the individual and corporate alternative minimum taxes, interest on Series 2017B bonds is treated as an item of tax preference for these purposes.

Security for the bonds is a lien on and security interest in project revenues, amounts payable to the city under a qualified swap, and all amounts on deposit in or credited to aviation funds. Project revenues are defined as any and all passenger facility charges, or any taxes which the City of Philadelphia may impose upon users of the airport system, any governmental grants and contributions in aid of capital projects, and more.

The purposes and uses of proceeds from the bonds are to currently refund certain outstanding commercial paper notes, currently refund all of the City of Philadelphia’s outstanding airport revenue bonds from Series 2007A and Series 2007B, as well as a portion of the outstanding bonds from Series 2009A. Also included are purposes to pay for a portion of 2017 capital projects, defined with other details on the purposes, tax-status, and security, as well as other matters pertaining to these Philadelphia airport revenue bonds, which can be found in the preliminary official statement, available on MuniOS.

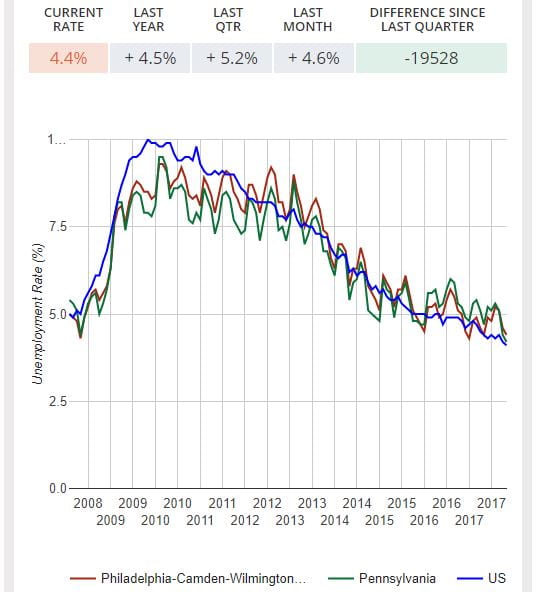

These Philadelphia airport revenue bonds are based off the Philadelphia International Airport, which serves the Philadelphia-Camden-Wilmington, PA-NJ-DE-MD Metropolitan Area. As of October 2017, the Philadelphia metropolitan area has an unemployment rate of 4.4%, which is 0.3% higher than the national rate for October, and 0.1% lower than at the same time in 2016. The chart below (click to expand) shows the Philadelphia metropolitan area, State of Pennsylvania, and U.S. unemployment rates for the past ten years. MuniNet provides this data and more, easily accessible, for all 50 states and each Metropolitan Statistical Area in the country, in our Employment Database.

Provided at left (click to expand) is a quick snapshot of financial characteristics of the Philadelphia International Airport as of 06/30/2016, compared with the medians for other large airports for 2015-2016, courtesy of Merritt Research Services, LLC. Some notable information is that while Philadelphia International has total liabilities well below the median of other large airports, it has a negative unrestricted fund balance, as well as a negative operating margin. It’s profit margin however is higher than the median for large airports. Merritt has many of the sector medians publicly available and regularly updated on their Benchmark Central page. (Merritt believes the data to be reliable but does not make any representations as to its accuracy or completeness). In addition to the Merritt information related to the featured bond, more information can be found on our municipal bond calendar, city, state, and county pages, and our employment database.

These facts and numbers are for informational purposes, and should not be considered an official disclosure for potential investors. Investors should consult the official statement. None of the information provided should be construed as a recommendation by MuniNet Guide, MuniNet LLC, Merritt Research Services LLC, or any of their employees. Information and analysis is for informational purposes only.

by Jeffrey L Garceau