The Port Authority of New York and New Jersey is scheduled to issue $1.1 billion in Consolidated Bonds this week. The negotiated sale is scheduled for November 19th with Bank of America as the lead manager. These Consolidated Bonds are being issued in two series to fund capital projects of the Port Authority and to refinance portions of its outstanding debt.

About the Bonds

The Two Hundred Seventeenth (2017) Series Bonds account for $400 million of the total bond issuance and is exempt from AMT. The Two Hundred Eighteenth (2018) Series Bonds contribute a much larger share to the total at $700, and is not exempt from AMT.

Apart from the AMT distinction, the Bond Series are the same in the following aspects. The Bonds are direct and general obligations of The Port Authority pledging the full faith and credit of the Port Authority for the payment of principal thereof and interest thereon. The Bonds are secured equally and ratably with all other Consolidated Bonds by a pledge of net revenues of all their existing facilities. Worth noting in regards to security, The Port Authority has no power to levy taxes and its obligations are not shared by the States of New York and New Jersey.

Along with net revenues, a special fund exists as an additional security for all Consolidated Bonds. After deducting payment of debt service upon all Consolidated Bonds, this fund is paid into by the balance remaining of all net revenues as required to maintain the General Reserve Fund of The Port Authority. Consolidated Bonds have a first lien upon the net revenues of all existing facilities of the Port Authority and any additional facility financed by Consolidated Bonds.

In the opinion of Counsel, interest on both the 2017 and 2018 Series is excluded from gross income for federal income tax purposes. Furthermore, the Bonds and interest thereon are exempt from any and all taxation (except estate, inheritance and gift taxes) imposed directly thereon by the States of New York and New Jersey. Both Series are subject to redemption prior to maturity, in whole, or, from time to time in part, at the Port Authority’s option.

The expected ratings from the various rating agencies are as follows: Moody’s : Aa3, Fitch: AA-, S&P: AA-.

About the Port Authority

Established in 1921, the joint state venture manages an enormous area of transit infrastructure including: five regional airports, the NY/NJ seaport, PATH rail transit system, six tunnels and bridges between the two states, the Port Authority Bus Terminal, George Washington Bridge Bus Station, and The World Trade Center site. It has an annual operating budget of approximately $8.5 billion and provides service to one of the largest transit networks in the country. The 2019 Budget includes approximately $3.3 billion in operating expenses and $3.7 billion in capital investment, with the remaining amount of approximately $1.5 billion covering debt service and deferred and other expenses.

These details and more on purposes, security, risks and other matters pertaining to these Bonds can the found in the official statement, provided by MuniOS. After registering, if needed, visitors can link directly to the official statement as well as an investor’s roadshow by searching for the ‘Port Authority’.

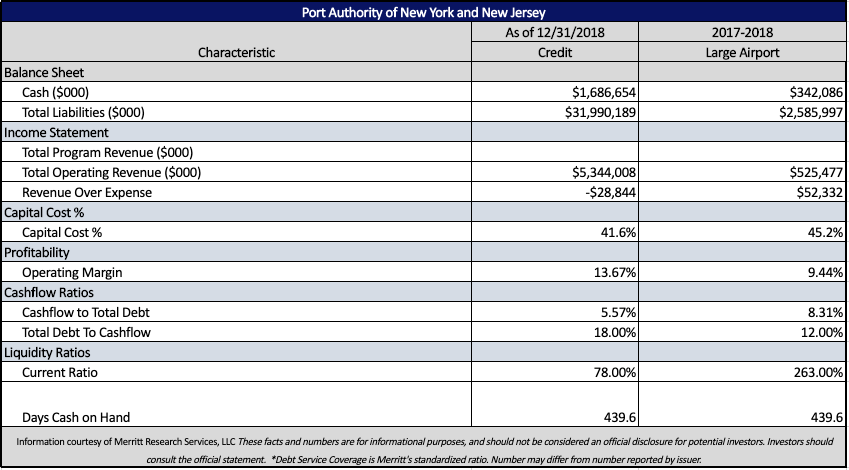

Below is a snapshot of The Port Authority Finances with regard to Airports within the system:

Provided above is a quick snapshot of financial characteristics of the Port Authority of New York and New Jersey along with the medians for all other stand alone airports, courtesy of Merritt Research Services, LLC. Merritt has many of the sector medians publicly available and regularly updated on their Benchmark Central page. (Merritt believes the data to be reliable but does not make any representations as to its accuracy or completeness).

In addition to the Merritt information related to the featured bond, more information can be found on our municipal bond calendar, city, state, and county pages.

These facts and numbers are for informational purposes, and should not be considered an official disclosure for potential investors. Investors should consult the official statement. None of the information provided should be construed as a recommendation by MuniNet Guide, MuniNet LLC, Merritt Research Services LLC, or any of their employees. Information and analysis is for informational purposes only.

Potential investors should rely only on the official documents and figures provided in the official statement (prospectus). Although the numbers presented in this summary are primarily derived from public documents, including issuer audits, issuer reports and other public sources such as federal reporting agencies , they are not intended to replace official information presented in connection with the bond sale. Medians may differ from official sales documents due to methodology or survey base variances.