Featured Bond – Week of May 6, 2019: Commonwealth of Massachusetts $700 in General Obligation Bonds

Overview

The Commonwealth of Massachusetts is issuing an aggregate $700 Million in General Obligation Bonds to be sold through a competitive process on May 7. There are four Bonds being issued – Series 2019C Bonds for $400 Million, and Series D, E, and F each at $100 Million. The proceeds of the Bonds are being used to finance or reimburse authorized capital projects in the State.

The Bonds have been assigned ratings of AA+, Aa1, and AA by Fitch, Moody’s, and S&P, respectively.

About The Bonds & Massachusetts

The proceeds of these bonds will finance or reimburse capital expenditures that are included in the capital investment plan which is maintained by the Executive Office for Administration and Finance. The capital investment plan for the Commonwealth is updated on a rolling basis and spans a five-year period. The plan coordinates capital expenditures by state agencies and authorities that are funded by Commonwealth debt and federal reimbursements. A bond cap is introduced on the debt. The administrative bond cap for the investment plan for Fiscal Year 2019 through Fiscal Year 2023 is $2.34 billion. This is an increase of 3.5% from Fiscal Year 2018.

In 2018 Massachusetts had a 3.7% unemployment rate which is right in line with the state median of 3.8%. Massachusetts had a total tax revenue of $24,627,517 in 2018.

Security for the Bonds

The Bonds will be general obligations of the Commonwealth to which its full faith and credit will be pledged for the payments. One note is that Chapter 62F of the Massachusetts General Laws imposes a state tax revenue growth limit and does not exclude principal and interest payments on Commonwealth debt obligations from the scope of this limit. Currently, actual tax revenue growth is below the statutory limit. From the opinion of the Bond Counsel, the Bonds are federally tax exempt. They are also exempt from Massachusetts personal income taxes and Massachusetts personal property taxes.

The Bonds have been assigned ratings of AA+, Aa1, and AA by Fitch, Moody’s, and S&P, respectively.

These details and more on purposes, security, risks and other matters pertaining to these Massachusetts General Obligation bonds can the found in the official statement, provided by MuniOS. After registering, if needed, visitors can link directly to the official statement as well as an investor’s roadshow by searching for the Commonwealth of Massachusetts.

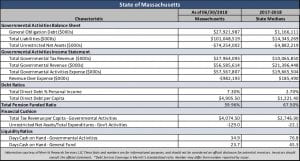

Statistical Snapshot: State of Massachusetts Selected Financial and Economic Indicators

State of Massachusetts financial snapshot as of June 30, 2018 Fiscal Year Audit. Source: Merritt Research Services, LLC

Provided above is a quick snapshot of financial characteristics of Massachusetts along with the medians for other states of all sizes, courtesy of Merritt Research Services, LLC. Merritt has many of the sector medians publicly available and regularly updated on their Benchmark Central page. (Merritt believes the data to be reliable but does not make any representations as to its accuracy or completeness).

In addition to the Merritt information related to the featured bond, more information can be found on our municipal bond calendar, city, state, and county pages.

These facts and numbers are for informational purposes, and should not be considered an official disclosure for potential investors. Investors should consult the official statement. None of the information provided should be construed as a recommendation by MuniNet Guide, MuniNet LLC, Merritt Research Services LLC, or any of their employees. Information and analysis is for informational purposes only.

Potential investors should rely only on the official documents and figures provided in the official statement (prospectus). Although the numbers presented in this summary are primarily derived from public documents, including issuer audits, issuer reports and other public sources such as federal reporting agencies , they are not intended to replace official information presented in connection with the bond sale. Medians may differ from official sales documents due to methodology or survey base variances.