– by Robert Crump

The State of California is expected to issue $2.2 billion in General Obligation Bonds this week. The negotiated sale is scheduled for March 10th with an amortization schedule between 2021 and 2050 and Citigroup and RBC and joint senior managers. Proceeds from the sale of the Bonds will be used to finance voter approved capital projects in the State and refund certain outstanding general obligation debt of the State.

About the Bonds

The Bonds, along with all of California’s other general obligations, are payable from moneys in the General Fund. However, State law stipulates that general obligations cannot take priority over the funding of public school systems and public institutions of higher education. This fixed rate bond issuance is secured by the full faith and credit of the State of California. The pledge of the full faith and credit alone does not create a lien on any particular moneys in the General Fund, but is an undertaking by the State to use its taxing powers as may be required for payment of the Bonds.

The Bonds are subject to optional and mandatory redemption provisions prior to maturity as defined in the preliminary official statement. In the opinion of bond counsel, interest on the Bonds is exempt from federal, State of California personal income taxes, and the alternative minimum tax. Moody’s, S&P, and Fitch have granted the Bonds ratings of Aa2, AA-, and AA respectively. Proceeds of the Construction Bonds ($1 billion) will be used to finance or refinance capital facilities and pay commercial paper notes. Proceeds from the Refunding Bonds ($1.2 billion) will be used to refund a portion of the State’s outstanding general obligation bonds for debt service savings.

Golden State

California is by far the most populous state in the nation, with an estimated 39.96 million residents as of 2019. Its population is nearly 40 percent larger than that of the second most populous state and it contains 12 percent of the total U.S. population. The state’s population is projected to continue to grow over the long term and reach 45 million residents by 2060.

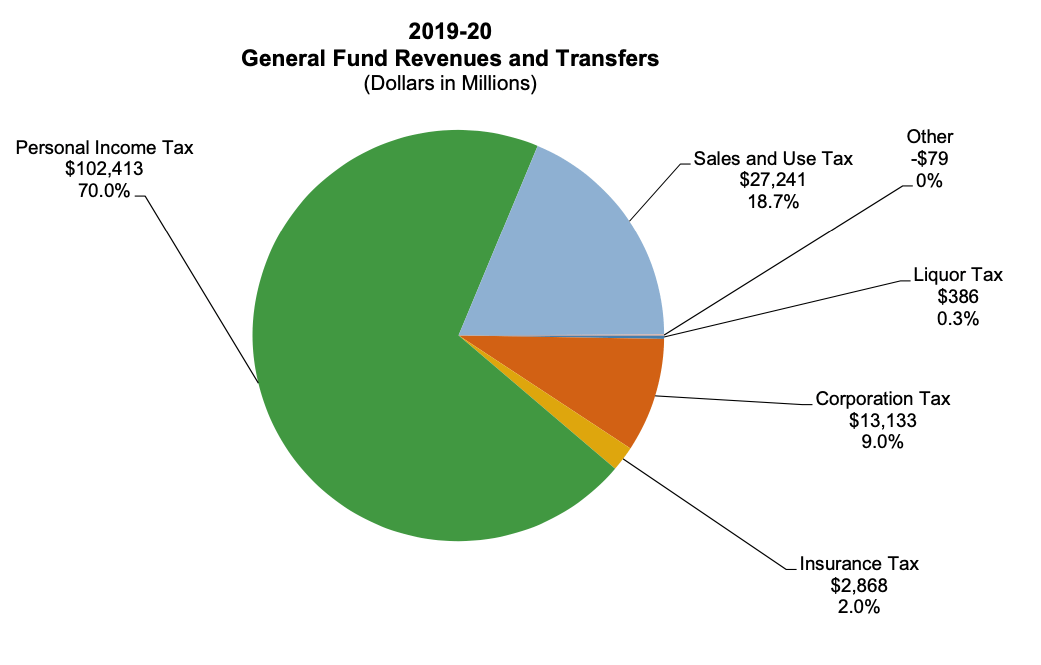

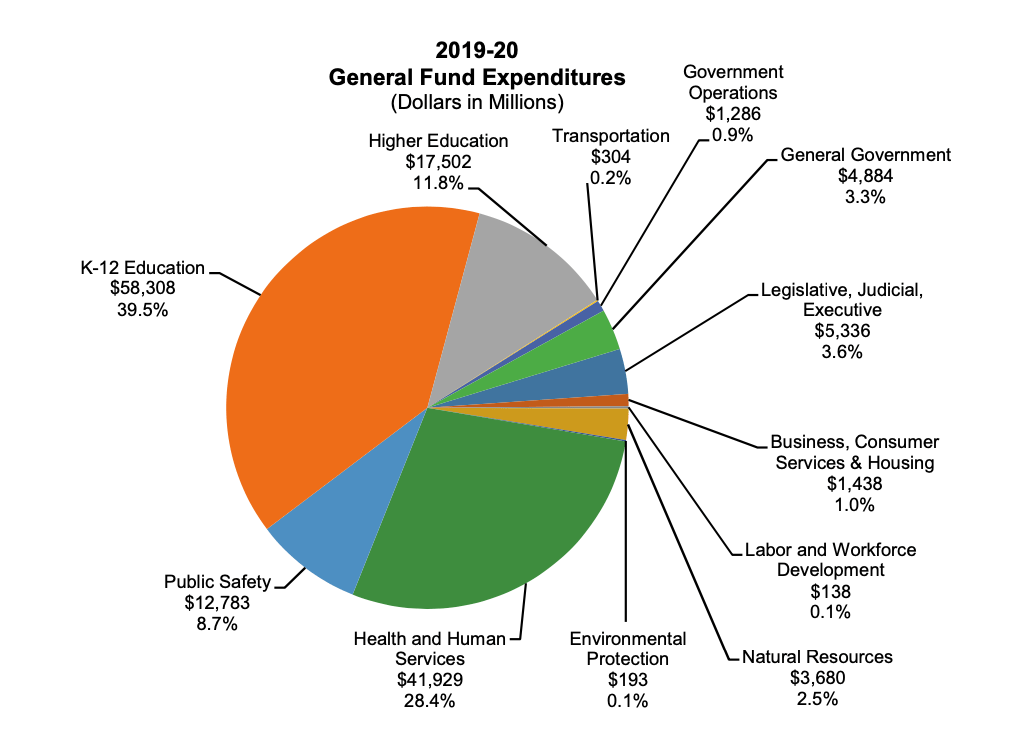

California’s GDP accounted for 14.6 percent of the national total in the first three quarters of 2019 and is currently the fifth largest in the world. The state has an exceptionally diverse economy with major components in high technology, trade, entertainment, manufacturing, government, tourism, construction and services. California also boasts an impressive 3.9 percent state unemployment rate as of December 2019 and per capita personal income of $63,557 reported for 2018. These facts and more can be seen on the preliminary official statement. See below for graphs related to the State’s General Fund and a table on the State’s finances.

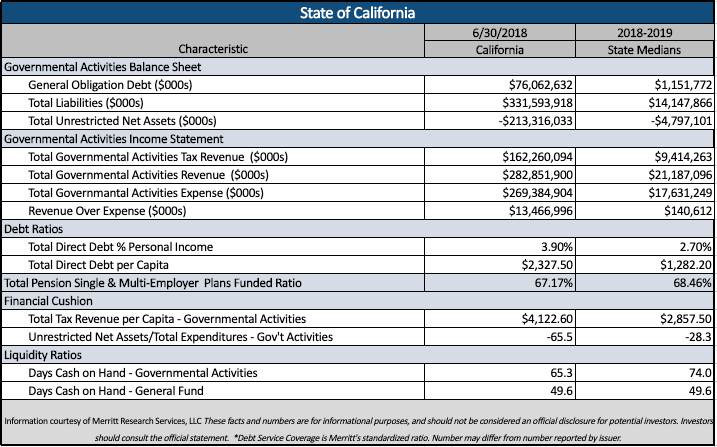

Snapshot of the state’s finances as of FY 2019 ending on June 30th 2018

Provided above is a quick snapshot of financial characteristics of the State of California, courtesy of Merritt Research Services, LLC. (Merritt believes the data to be reliable but does not make any representations as to its accuracy or completeness). In addition to the Merritt information related to the featured bond, more information can be found on our municipal bond calendar, city, state, and county pages.

These facts and numbers are for informational purposes, and should not be considered an official disclosure for potential investors. Investors should consult the official statement. None of the information provided should be construed as a recommendation by MuniNet Guide, MuniNet LLC, Merritt Research Services LLC, or any of their employees. Information and analysis is for informational purposes only.

Potential investors should rely only on the official documents and figures provided in the official statement (prospectus). Although the numbers presented in this summary are primarily derived from public documents, including issuer audits, issuer reports and other public sources such as federal reporting agencies , they are not intended to replace official information presented in connection with the bond sale. Medians may differ from official sales documents due to methodology or survey base variances.