The City & County of Honolulu, Hawaii –$250 million GO Bonds for Rail Transit Project

Photo via https://www.goodfreephotos.com/

The City and County of Honolulu is issuing $250,340,000 General Obligation Bonds to finance the rail transit project under construction by the Honolulu Authority for Rapid Transit (HART).

The mass transit projct encompasses a 20 mile guideway that provides passenger serivice spanning an east-west corridor along the island of Oahu. Nearly 70% of the island’s population lives within the area’s service area and its 21 stations and transit centers .

The total estimated cost of the overall HART project is $8.3 billion, which is being funded by multiple sources, including the bonds. As of October 2018, appoximately 47% of the overall mass transit project was reported as complete.

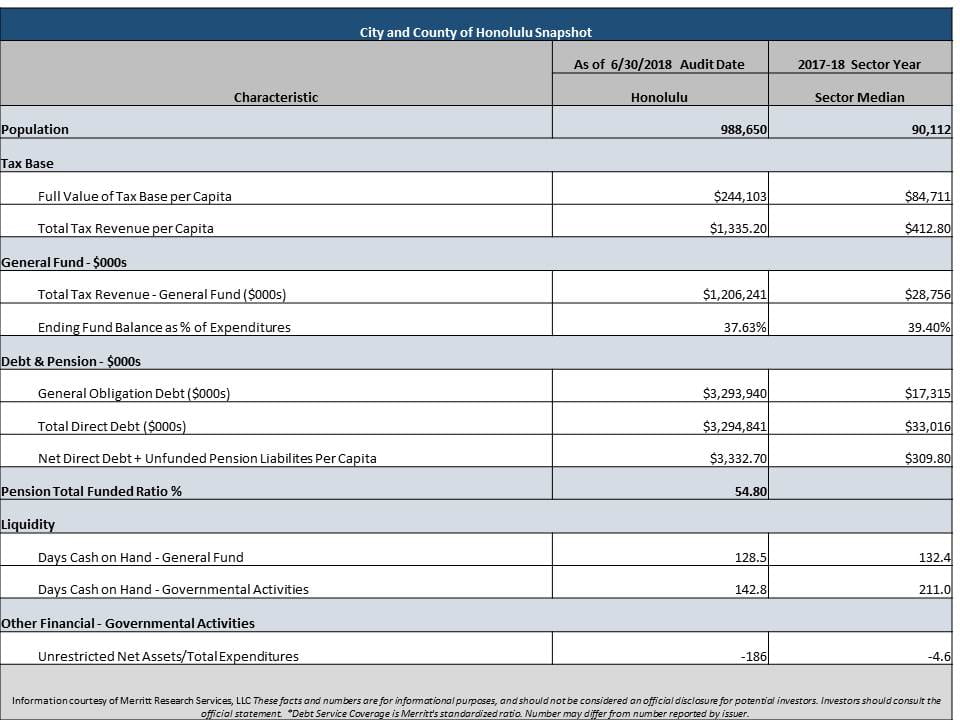

Honolulu’s population is 988,650 and its unemployement registered a relatively low 2.3% at the end of October, 2018. The city is the capital of the state and a center of commerce, transportation, military operations and tourism. The city’s median income and median housing values are well above the nation averages.

The bonds are general obligations of the City and County. Principal and interest payments on the bonds are a first charge on the general fund of the City and County. Honolulu’s full faith and credit of the City and County is pledged. The City & County has the power and is obligated to levy ad valorem taxes, without limit as to rate or amount, on all real property subject to taxation by the city and county.

The assessed valuation of the city and county’s tax base has grown steadily in the last five years with a total cummulative increase of about 33% since 2014. The city reports that there is a pipeline of future real estate projects, especially in its inner core area. The city and county encompasses the entire island of Oahu. The city’s relative real estate valuation is refected in its Full value per capita of $244,103 as shown in the Merritt Research Services data shown in the table below.

About the Bonds

The bonds are being sold in two parts with the Series 2019A bond issue in the amount of $212.2 million and the Series 2019B bond issue in the amount of $38.2 million. The bonds are rated by Moody’s as Aa1 and by Fitch as AA+. The bonds are being sold by a negotiated underwriting group led by BofA Merrill Lynch as senior manager.

The bonds will be issued as serial bonds with escalating amounts for each maturity with principal repayments on the SeriesA Bonds beginning in 2023 and continuing until 2030. The first principal payment on the SeriesB bonds will begin in 2019 and ending in 2043.

Interest on the Series 2019A and 2019 B bonds are in the opinion of Bond Counsel tax-exempt for federal income and state of Hawaii tax purposes.

Details on the purposes, tax-status, security, as well as other matters and risks pertaining to these bonds can be found in the preliminary official statement ( register on the MuniOS website and searching for City and County of Honolulu).

After registering, visitors can link direct to the official statement as well as an issuer Roadshow for the City and County of Honolulu, Hawaii.

Statistical Snapshot of Key Honolulu Financial and Economic Indicators

These facts and numbers are for informational purposes, and should not be considered an official disclosure for potential investors. Investors should consult the official statement. None of the information provided should be construed as a recommendation by MuniNet Guide, MuniNet LLC, Merritt Research Services LLC, or any of their employees. Information and analysis is for informational purposes only.