Featured Municipal Bond Issue, Week of December 3, 2018: The City of Chicago, Chicago O’Hare International Airport Sr. Lien Revenue Bonds – $1.85 Billion

This week’s featured bond is also the largest offering in the negotiated market scheduled for the week of December 3, 2018. The City of Chicago is issuing $1.85 billion in airport senior lien revenue bonds. These revenue bonds are being issued as three separate series. The General Airport Senior Lien Revenue and Refunding bonds, Series 2018A are tax-exempt and subject to the federal Alternate Minimum Tax (AMT) as they are considered private activity bonds, The General Airport Senior Lien Revenue Bonds, Series 2018B are also tax-exempt but they are not subject to the AMT. The General Airport Senior Lien Revenue Bonds, Series C are taxable under federal tax laws.

The 2018 Senior Lien Bonds will be limited obligations of the City of Chicago payable from and secured by a pledge of revenues derived from the operation of O’Hare and will be secured on an equal (parity) basis as the pledged revenues with the City’s Outstanding parity O’Hare Senior Lien bonds. The pledged revenues are substantially derived from payments of rentals, fees and charges made in conjunction with the Airport’s airline use and lease agreements by the “Signatory Airlines” that use O’Hare and are signatories to such airline use and lease agreements (as described in the official statement associated with this offering. The Bonds being offered are not general obligations of the city of Chicago, the state or any other political subdivision of Illinois.

The purposes and uses of proceeds from the bonds are being used to fund portions of the Airport’s capital program, refund certain outstanding Senior Lien Bonds, repay portions of commercial paper notes and credit agreement nots, fund the reserve requirement for the 2018 senior lien bonds, capitalize a portion of the interest and pay costs of issuance. Details on these matters are available in the official statement, which is available on MuniOS. New visitors to MuniOS, must register first on the site to select documents associated with bond issues.

The Chicago Ohare International Airport is the primary commercial airport for the City of Chicago and the surrounding region. O’Hare ranked second worldwide and second in the United States in total aircraft operations, and sixth worldwide and third in the United States in terms of total passengers according to the Airports Council International based on 2017 statistics. Both United Airlines and American Airlines have major hubs at O’Hare and together account for more than 50% of the airport’s market share.

O’Hare, which serves the Chicago-Naperville-Elgin, IL-IN-WI Metropolitan Area, recorded a 3.7% unemployment rate in September 2018 (See more employment statistics on MuniNet’s Employment Data pages).

MuniNet provides this data and more, easily accessible, for all 50 states and each Metropolitan Statistical Area in the country, in our Employment Database.

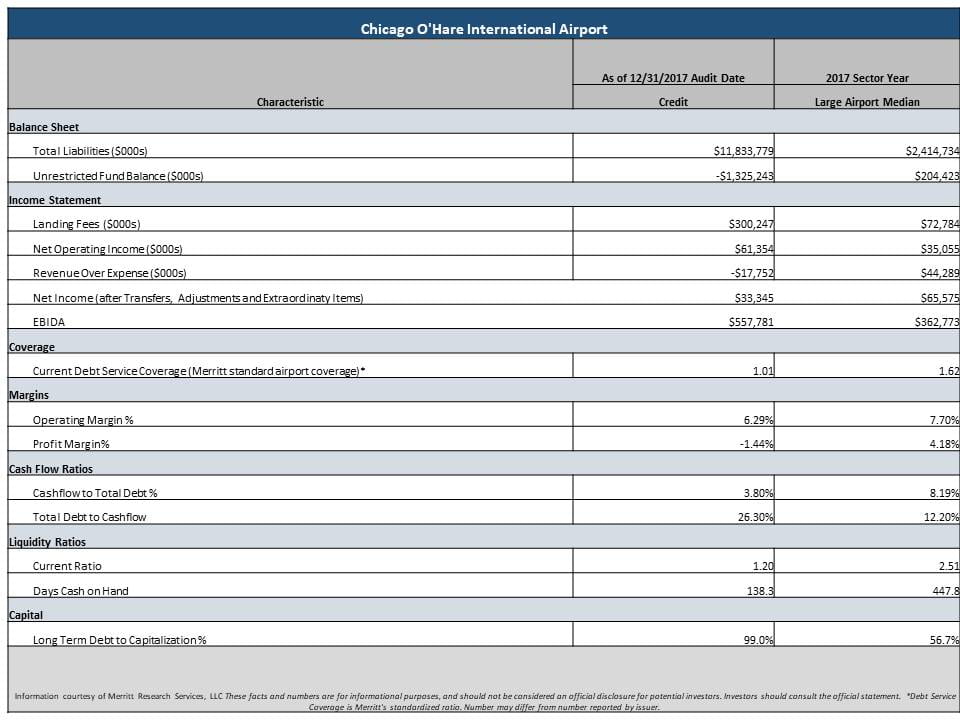

Merritt has many of the sector medians publicly available and regularly updated on their Benchmark Central page. (Merritt believes the data to be reliable but does not make any representations as to its accuracy or completeness). In addition to the Merritt information related to the featured bond, more information can be found on our municipal bond calendar, city, state, and county pages, and our employment database.

These facts and numbers are for informational purposes, and should not be considered an official disclosure for potential investors. Investors should consult the official statement. None of the information provided should be construed as a recommendation by MuniNet Guide, MuniNet LLC, Merritt Research Services LLC, or any of their employees. Information and analysis is for informational purposes only.

‘

‘

‘

‘