Data Reveals that Median Housing Values and Local Property Tax Bases Have a Positive Relationship, But Tax Bases Outperform Housing

Housing values are important not only for home owners and prospective buyers, but also for local governments. They are an important measurement of economic health, and of the property tax base needed to provide desired government services. The housing market has partially recovered from its widespread collapse in the late 2000s; however, headlines may be misleading if they highlight growth numbers from the bottom of the collapse. A report by Trulia released last year showed that only one-third of houses in the nation have surpassed their pre-recession peak value.

Property taxes are popular among lawmakers and government officials because of their stability. Unlike income and sales taxes, property taxes tend not to vary widely in generated revenues with the business cycle. Properties are not always assessed every year, so one- or two-year swings in housing values may not have much of an impact on a property tax base. But can large, sustained value losses have lasting effects on the property tax base, putting strain on the fiscal condition of local governments? The housing crisis of the late 2000s, and the (limited) recovery of housing prices in the years to follow, provides a great case study to test the principle of property tax base sustainability in the face of sustained, significant declines in housing values.

Do overall property tax bases rise and fall with property values? Over 61% of the cities that had declining median housing values nevertheless experienced an increase in estimated full value. Less than 1% of cities with positive housing value growth experienced tax base decline.

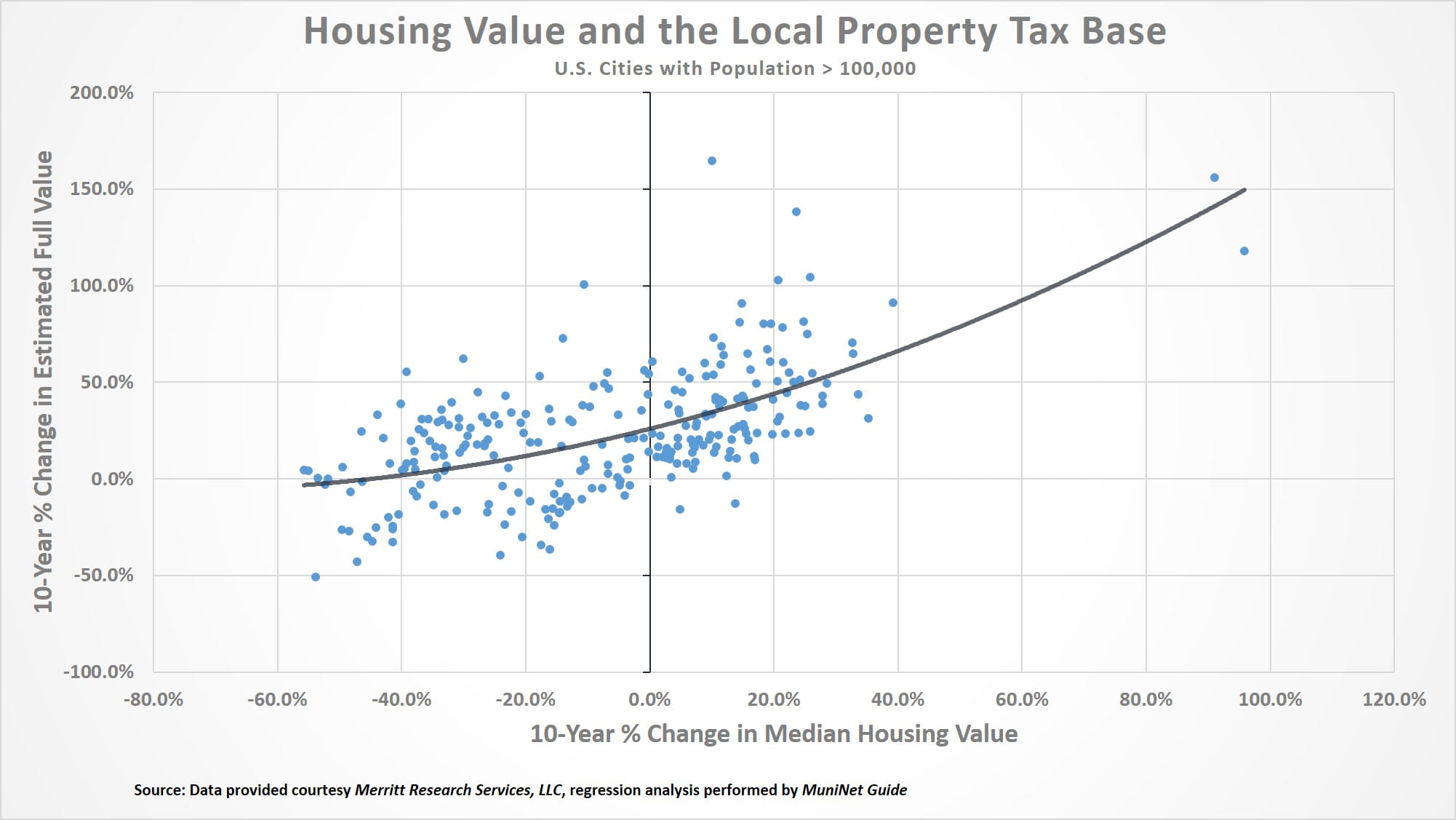

To look at how property tax bases held up against the housing crisis, we used data from Merritt Research Services, LLC of the estimated full value of property (property tax base) and median housing values of U.S. cities listed in the 2010 Census as having populations over 100,000*. We calculated the percentage changes in estimated full value, and median housing values from 2007 (the year housing prices peaked) forward ten years to 2016. We then took these values and plotted them in a regression to see how property tax bases changed relative to changes in median housing values over that time frame. This ten-year span includes the five years from 2007 to 2012, when housing prices bottomed out, and the following five years of recovery: a good window of time for our analysis. Do overall property tax bases rise and fall with property values, or do they ride out the changes in the tide?

Findings

Less than half (44.9%) of cities over 100,000 experienced a positive change in median housing values from 2007-2016. Meanwhile, four out of five (79.6%) of cities in our study had positive growth in their estimated full value from 2007-2016. Clearly, more cities experienced property tax base growth than median housing value growth. When looking at the difference between the ten-year change in estimated full value and median housing value, we find that 90.9% of cities with populations over 100,000 had tax base growth rates that outpaced median housing values.

Looking at a quadratic regression plot of all 265 cities in our study, we see a positive correlation between changes in median housing values and estimated full value for large cities. As housing values increase, so do overall property tax bases. This is a finding we would expect, but some items are noteworthy:

- First, the relationship accelerates as housing values increase; the relationship is not steady across the growth spectrum.

- The chart reveals two outliers at the far right end of the chart, Midland and Odessa, TX. These cities are only a couple of miles apart, and both benefited from a significant boon in local shale oil production over the past decade. The same accelerating pattern exists in the data even when these two cities were removed.

- Over 61% of cities with declining median housing values nevertheless experienced an increase in estimated full value. Only two cities with positive housing value growth experienced tax base decline.

A few illustrative cities:

- Detroit, MI saw its median housing value shift -53.9%. Its estimated full value followed closely, moving -50.7% over the ten year period.

- Phoenix, AZ had a fairly stable property tax base (4.2%) despite significant declines in housing values (-33.1%).

- Providence, RI had a strong growth in its property tax base (30.6%) even though its median housing values have yet to recover (-33.5%).

Lessons

Given our findings, we see that despite certain markets like San Francisco and Washington D.C. experiencing newsworthy surges in housing prices, many of the country’s larger cities have housing values that have yet to recover from the Great Recession. Furthermore, we see that for larger cities, housing values are a contributor to growth in the overall tax base, but their local governments can achieve revenue stability or even growth despite lagging housing values. Were we to perform the same study, but instead examining bedroom/commuter communities, we would likely see housing values have a larger impact on the tax base. We did not examine what impacts, if any, differences in property assessment policies, which are set at the state level, could have had on the variance between housing values and estimated full value. However, looking at cities nationally should account to some degree for any effects of policy variations. Officials of large cities should take heart that their tax base can in many cases out-perform even significant housing value struggles.

*We did not include cities for which we did not have full sets of data, but were still able to look at 265 of the 310 largest cities in the United States (85.5% of the group).

by Jeffrey L Garceau