Featured Municipal Bond Issue, Week of February 19, 2018: Los Angeles Unified School District General Obligation Bonds – $1.35 Billion

The Los Angeles Unified School District is issuing $1.35 billion in general obligation bonds the week of February 19, 2018. These general obligation bonds are being issued as two separate series, each divided into two sub-series:

- Series M – $130 million in Dedicated Tax Ad Valorem Property Tax Bonds, consisting of:

- Series M-1 – $115 million, tax-exempt

- Series M-2 – $15 million, federally taxable

- Series B – $1.2 billion in Dedicated Tax Ad Valorem Property Tax Bonds, consisting of:

- Series B-1 – $1.1 billion, tax-exempt

- Series B-2 – $140 million, federally taxable

The proceeds of the Series M bonds will be used to finance school facilities projects approved by voters in the November 08, 2005 election, and the Series B bonds will be used to finance school facilities projects approved by voters in the November 04, 2008 elections.

Security for these bonds is an obligation to levy ad valorem taxes upon all property subject to taxation in the District, without limitation to rate or amount. This obligation is secured by a statutory lien. Details on the purposes, tax-status, security, as well as other matters pertaining to these bonds can be found in the preliminary official statement, are available on MuniOS.

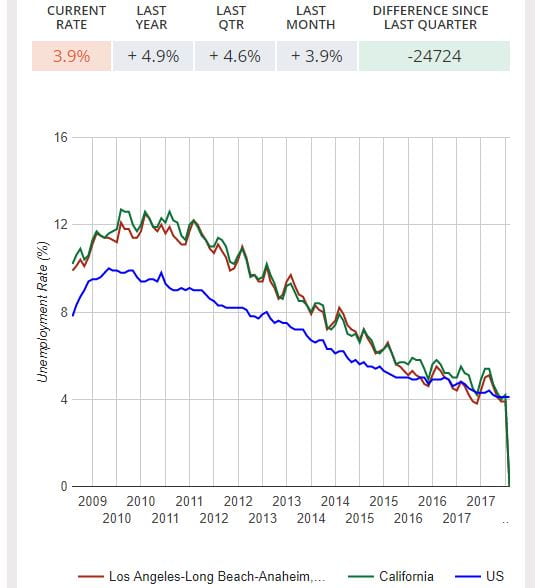

The Los Angeles Unified School District serves a major part of the Los Angeles-Long Beach-Anaheim, CA Metropolitan Area. As of December 2017, the Los Angeles Metropolitan Area has an unemployment rate of 3.9%, which is 0.2% lower than the national rate for December, and 1.0% lower than at the same time in 2016. MuniNet provides this data and more, easily accessible, for all 50 states and each Metropolitan Statistical Area in the country, in our Employment Database.

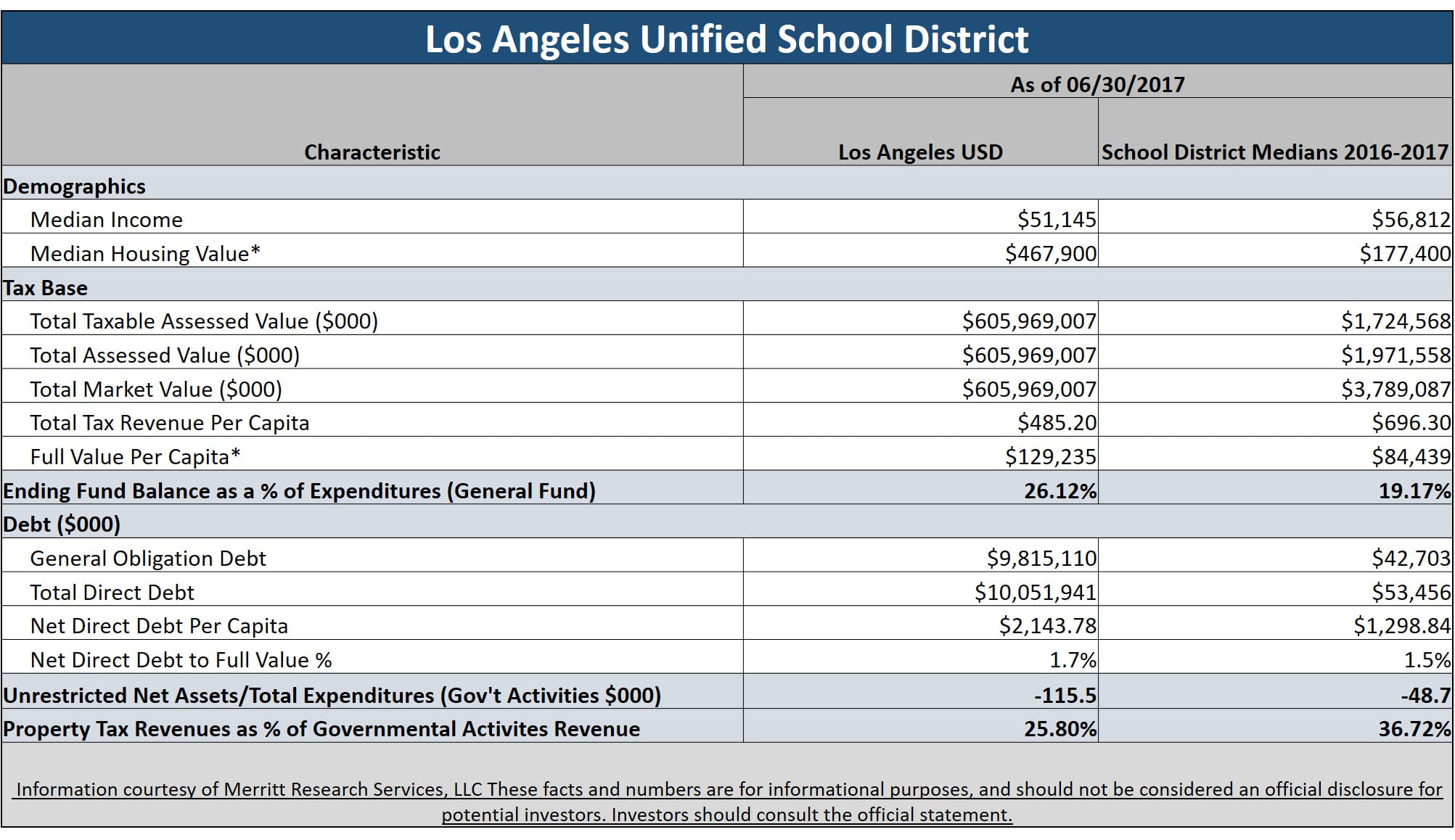

Provided at left (click to expand) is a quick snapshot of financial characteristics of Los Angeles USD as of 06/30/2017, compared with the medians for other public higher education organizations, courtesy of Merritt Research Services, LLC. Merritt has many of the sector medians publicly available and regularly updated on their Benchmark Central page. (Merritt believes the data to be reliable but does not make any representations as to its accuracy or completeness). In addition to the Merritt information related to the featured bond, more information can be found on our municipal bond calendar, city, state, and county pages, and our employment database.

Provided at left (click to expand) is a quick snapshot of financial characteristics of Los Angeles USD as of 06/30/2017, compared with the medians for other public higher education organizations, courtesy of Merritt Research Services, LLC. Merritt has many of the sector medians publicly available and regularly updated on their Benchmark Central page. (Merritt believes the data to be reliable but does not make any representations as to its accuracy or completeness). In addition to the Merritt information related to the featured bond, more information can be found on our municipal bond calendar, city, state, and county pages, and our employment database.These facts and numbers are for informational purposes, and should not be considered an official disclosure for potential investors. Investors should consult the official statement. None of the information provided should be construed as a recommendation by MuniNet Guide, MuniNet LLC, Merritt Research Services LLC, or any of their employees. Information and analysis is for informational purposes only.

by Jeffrey L Garceau