Residents can plug in their home’s value, see how taxes are spent by category with property tax tool

A piece of MuniNet Guide’s mission is to mine the web for relevant information on municipal finance, infrastructure, public policy, and numerous other issues, seeking out places that may not show up on the first page of your web browser of choice. One of those places is Grimes, Iowa’s official website. Grimes offers a property tax tool, which allows you to enter your home’s Net Assessed Value, and get two dollar-figure breakdowns.

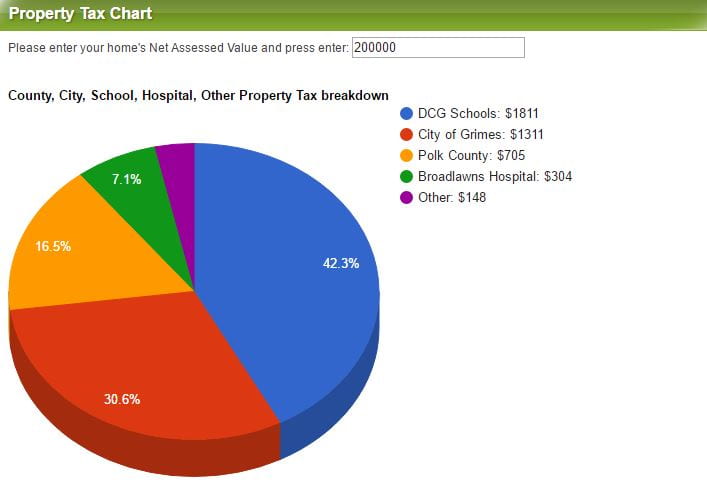

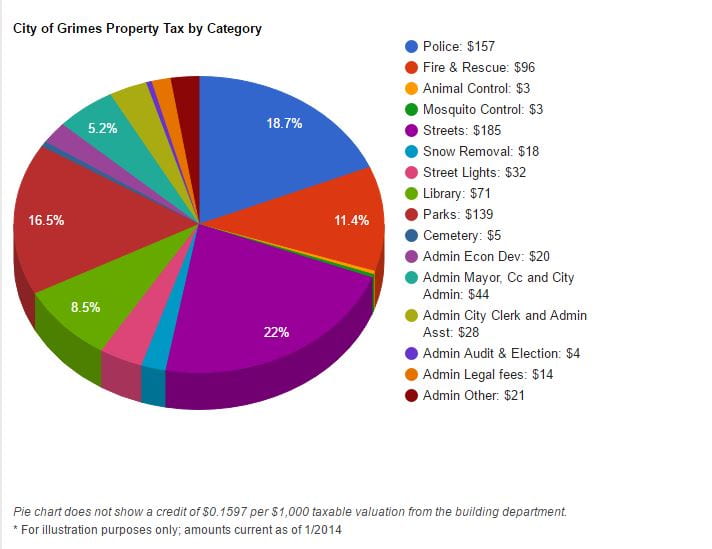

The first gives you a breakdown of what local government entities get pieces of your overall tax bill. Dallas Center-Grimes School District gets the largest portion, the City of Grimes is next, followed by Polk County, the hospital, and various other special districts. The next breakdown shows how the City of Grimes spends its share of property taxes by category. Streets and Parks receive the largest shares of spending, and Policy, Fire & Safety, and the Library system follow.

As an illustration, the charts below show what a Grimes resident would pay if their home had a Net Assessed Value of $200,000. Such a household would owe $4,279 in total property taxes, $1,311 of which would go to the City of Grimes. Of that portion, $71 from that household’s tax bill would go toward supporting the local library.

These types of tools make it easy for citizens to see how their tax dollars are being spent, allowing them to make more informed decisions as voters. MuniNet Guide found this property tax calculator by visiting one of our Citizen Participation Top Picks, the Governmental Research Association, and their affiliate, the Taxpayers Association of Central Iowa. You can find more Top Picks for research and information at our Citizen Participation page, or find valuable resources on a wide variety of topics in our NFMA Gateway.

by Jeffrey L Garceau