Municipal Government Audit Times Likely Affected by GASB Pension Rules

A longstanding complaint among municipal bond analysts and investors is that municipal bond credit disclosures are slow to be reported, and not as timely as they are for other securities in the market. In its latest annual update on the subject, Merritt Research Services, LLC, an independent municipal bond credit data and research company, found that not only did relatively slow municipal bond related audit times continue to persist in 2015; but, the trend actually worsened for most state and local governments and their agencies. On the other hand, hospitals, retail electric issuers, private universities and miscellaneous special revenue borrowers generally held their ground and completed their audits during a time period that was close or better than their pace for the previous year.

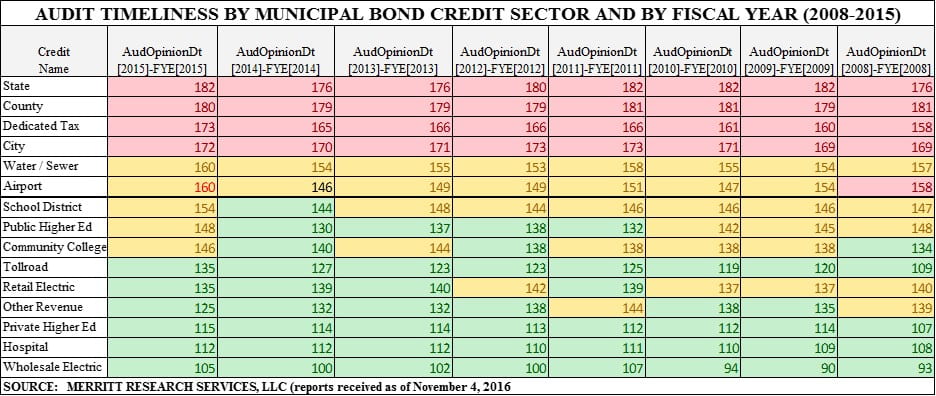

Merritt Research Services published its first report tracking municipal issuer audit times in 2010. The latest analysis takes a cumulative look back at more than 84,000 audits, encompassing the period 2007 through 2015, to document the time it takes an entity to finish and sign its audit after the close of its fiscal year. For the most recent 2015 fiscal year, nearly 10,000 audits from a broad spectrum of municipal bond related entities, encompassing state and local governments, their agencies, as well as not-for-profit organizations, were examined to compile audit completion times by individual entities and by credit sector.

Audit timeliness remains an essential requisite to taxpayer as well as market accountability and transparency.

Across the board, it took municipal bond entities a median time of 151 days in 2015 to finish their audit, Reporting times as usual varied dramatically among individual borrowers as well as specific credit sectors. Syracuse University, a perennially prompt reporter of its audit, was able to finish its FY 2015 audit in as little as 29 days (eight year average is 31 days) while a number of municipal bond related borrowers, such as the city San Bernardino, CA and the city of Richmond, VA took well over one year.

It is not uncommon to wait more than two years for the finished audit report whenever serious fiscal distress exists, which explains why San Bernardino, a city that was still in bankruptcy in 2015 took 456 days to sign off on its books. Substantially longer delays are found when you have the longer term benefit of looking at earlier fiscal years. In the case of the financially troubled city of Harvey, IL it took 804 days to release its 2014 audit and a whopping 1,026 days (almost three years) for Vallejo Unified School District, CA to sign off on its FY 2013 audit.

On the whole, municipal borrower audit completion times took longer in 2015 than in the prior seven years. More than likely, the newly effective Governmental Accounting Standards Board rules (Statements 67 and 68) related to pensions, factored into the recent setback for municipal audit times. It is too early to tell whether the back step in reporting times will be reversed in future years once state and local governments fully adjust to the new rules.

Audit timeliness remains an essential requisite to taxpayer as well market accountability and transparency. For municipal bondholders, late or stale audits inhibit accurate bond pricing and cloud assessments of risk.

Summary Findings of the Study:

- The median number of days that it took all Merritt tracked municipal credit sectors to complete their audits rose to 151 days, nine more than the 142 median days in FY 2014. The 2015 completion time marked the first year since 2008 that the median audit time for all entities covered by Merritt Research took more than 150 days. These numbers are best put into perspective when compared with corporate bond issues, whose annual audited reports are required by the Securities Exchange Commission in 60 to 90 days, depending on the size of the corporation.

- Thirteen of the 16 municipal bond credit sector types (i.e. groupings based on the type of government, not-for-organization or governmental special purpose) tracked by Merritt Research took longer to complete their FY 2015 financial audits than in the previous year.

- States & Territories, Counties, Cities and Dedicated Tax obligors generally took the longest times to finish their audits. States & Territories, a perennially slow reporter, had the worst showing of all sectors with the median audit time of 182 days while counties weren’t far behind at 180 days. Dedicated tax obligors and cities had median completion times of 173 and 172 days, respectfully. States and county sectors have been running at the back of the pack in every annual Merritt audit timing sector analysis since 2008.

- The worst credit sector slippage applied to airports which saw the median audit time slide from 146 in 2014 to 160 days in 2015

- The three best municipal bond related audit time sector performances belonged to Wholesale Electric, Hospital and Private Higher Education borrowers with sector medians of 105, 112 and 115 days in that order

- Only two sectors (Retail Electric and the miscellaneous category of Other Revenues) improved their audit reporting times in 2015 versus the previous year and one sector (Hospitals) stayed the same. Hospitals have been the steadiest reporting group based on audit timeliness since 2008; its completion time has stayed within a narrow range of around 111 to 112 days over the past six years.

- It is not uncommon for individual governments and organizations to show significant fluctuations relative to their audit completion times on a year to year basis. However, many reporting entities fall within a predictable variance in which their reporting release dates fall within a 30 day annual variance. Then, there are chronically late organizations, whose audits are finally made available well after the closing date of their fiscal years.

- New York State and New York City, which signed off on their 2015 audit reports in 115 and 121 days, respectively, deserve praise and recognition for their ability to maintain the relative timeliness of their reports each year since we first began tracking audits in 2007. New York State has produced its reports in a narrow range of 114 to 116 during the time period. Despite the complexity of New York City organizational structure and its early implementation of the GASB 67 and 68 rules for pensions in 2014, the city’s audit time has been as short as 115 days in 2009 and as long as 122 days in 2007. Columbus, Ohio has been another government with a perennially speedy reporting history, although it lost some ground in 2015 by finishing its audit in 113 days compared to 83 days in 2014 and 93 days or under since 2010.

- Governmental type of municipal borrowers were more than likely affected and slowed down in 2015 by the new experience of reporting pension information under the newly effective GASB 67 and 68 rules. Non-governmentally owned hospitals and private higher education institutions were not affected by the changes. Although all entities are subject to audit standards that comply with Generally Accepted Accounting Principles, non-profit organizations like hospitals and private colleges and universities normally follow Financial Accounting Standards Board Rules (FASB) while governmental organizations are subject to Governmental Accounting Standard Board Rules (GASB).

Richard A. Ciccarone, President & CEO of Merritt Research Services, LLC and Co-Publisher of MuniNet Guide