Featured Municipal Bond in the Market, Week of 10/24/2016: Chicago O’Hare International Airport Revenue Bonds – $1.1 Billion

This week’s featured bond comes from the State of Illinois. Chicago O’Hare International Airport is scheduled to issue $1.1 billion in Senior Lien Revenue Refunding Bonds the week of October 24, 2016. These bonds are scheduled to be issued in three series; Series 2016A at $29 million, Series 2016B at $479 million, and Series 2016C at $548 million. Series 2016B and Series 2016C are non-AMT. The purpose of the bonds are to refund previously issued airport revenue bonds. The bonds are Senior Lien Revenue Bonds, pledged by the revenue of O’Hare International Airport, which are subject to first lien on par with any previously issued or future issued senior lien bond series. These details and more on purposes, security, and other matters pertaining to these Alaska pension obligation bonds can the found in the official statement, provided by MuniOS.

As of August 2016, the Chicago-Naperville-Elgin Metro Area has an unemployment rate of 5.4%, which is 0.3% higher than at the same time in 2015, and 0.4% higher than the current national rate.

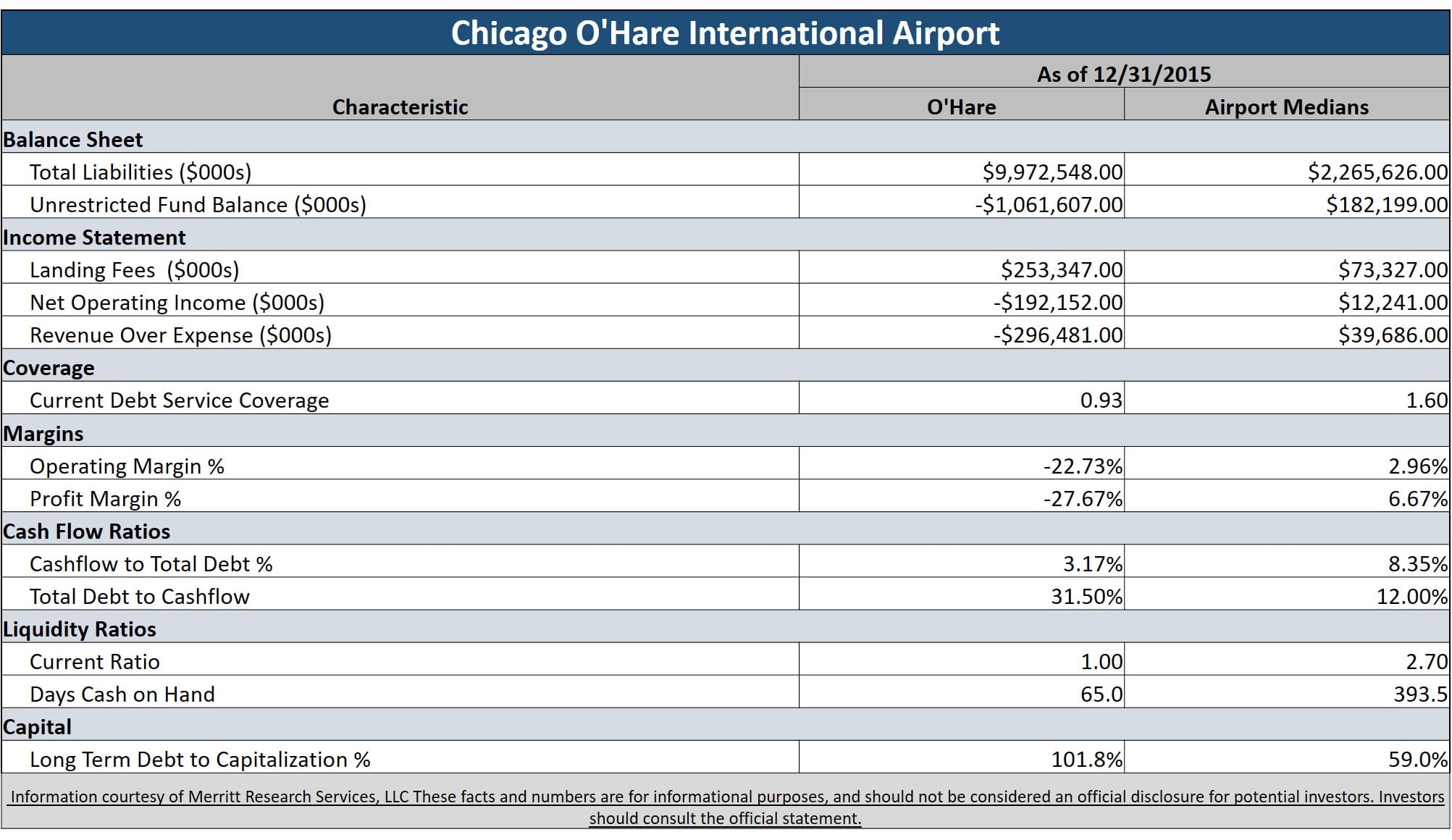

Provided at left is a quick snapshot of financial characteristics of O’Hare International Airport, along with the medians for other airports, courtesy of Merritt Research Services, LLC. Merritt has many of the sector medians publicly available and regularly updated on their Benchmark Central page. (Merritt believes the data to be reliable but does not make any representations as to its accuracy or completeness). In addition to the Merritt information related to the featured bond, more information can be found on our municipal bond calendar, city, state, and county pages, and our employment database. These facts and numbers are for informational purposes, and should not be considered an official disclosure for potential investors. Investors should consult the official statement. None of the information provided should be construed as a recommendation by MuniNet Guide, MuniNet LLC, Merritt Research Services LLC, or any of their employees. Information and analysis is for informational purposes only.

Provided at left is a quick snapshot of financial characteristics of O’Hare International Airport, along with the medians for other airports, courtesy of Merritt Research Services, LLC. Merritt has many of the sector medians publicly available and regularly updated on their Benchmark Central page. (Merritt believes the data to be reliable but does not make any representations as to its accuracy or completeness). In addition to the Merritt information related to the featured bond, more information can be found on our municipal bond calendar, city, state, and county pages, and our employment database. These facts and numbers are for informational purposes, and should not be considered an official disclosure for potential investors. Investors should consult the official statement. None of the information provided should be construed as a recommendation by MuniNet Guide, MuniNet LLC, Merritt Research Services LLC, or any of their employees. Information and analysis is for informational purposes only.