Featured Municipal Bond in the Market, Week of 07/25/2016: State of Tennessee

This week’s featured bond comes from the state of Tennessee. The Volunteer State is scheduled to issue $363 million in general obligation bonds the week of July 25, 2016. These bonds are broken up into three series: Series A are $175 million in tax-exempt bonds to be issued for the purpose of funding capital projects and to provide for retirement at maturity certain outstanding capital project issues; Series B ($124 million, tax-exempt) and Series C ($66 million, Federally taxable) are issued for the purpose of refunding certain outstanding general obligations of the state. Security for the bonds are backed by the full faith and credit of the State of Tennessee. More details on purposes, security, and other matters can the found in the official statement, provided by MuniOS. Tennessee currently has an unemployment rate of 5.0% as of June 2016, up fro 3.8% in May. Tennessee’s unemployment rate is 0.1% higher than the national rate of 4.9%.

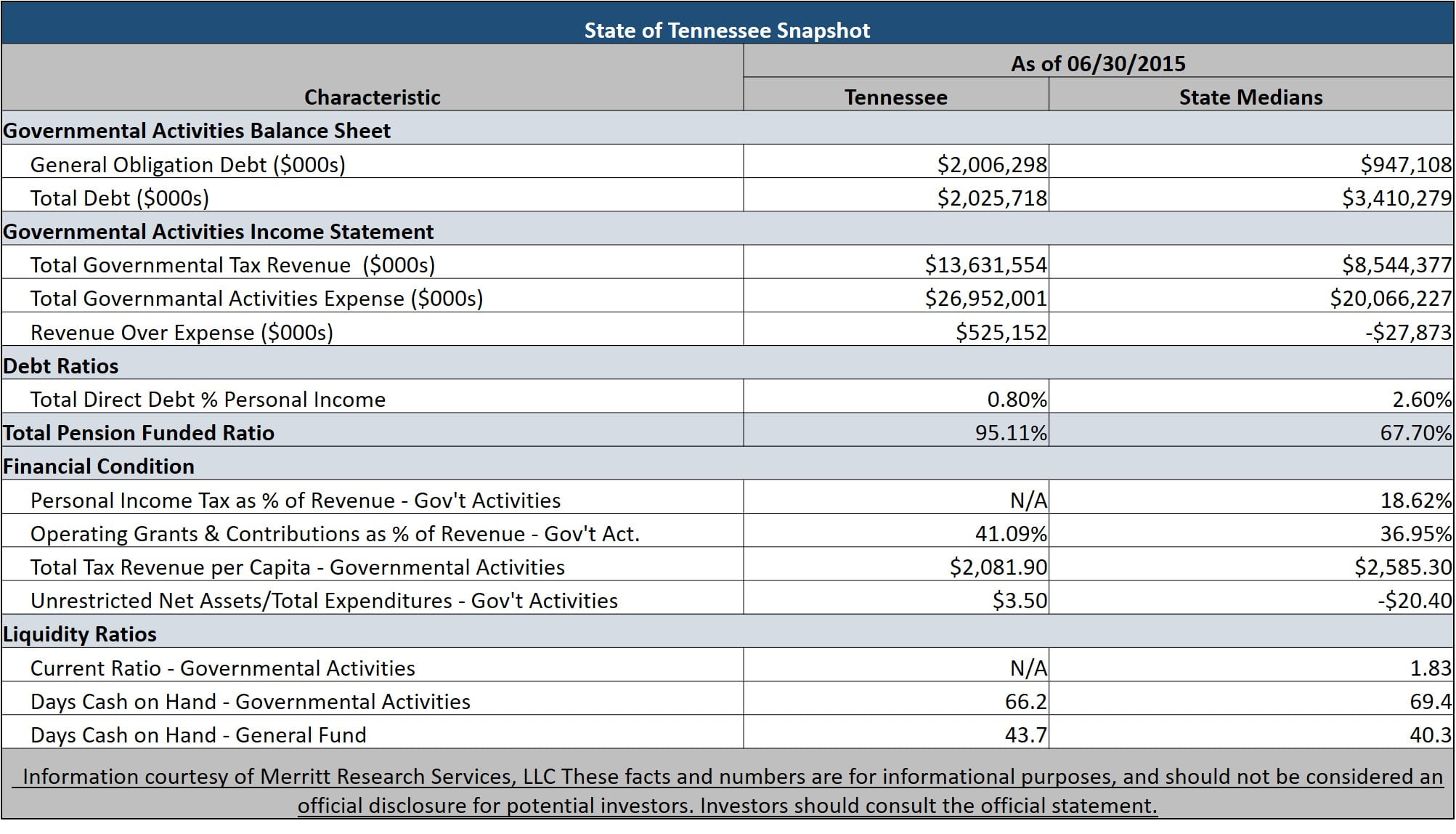

Provided at left is a quick snapshot of financial characteristics of the State of Tennessee, along with the state medians, courtesy of Merritt Research Services, LLC. Merritt has many of the sector medians publicly available and regularly updated on their Benchmark Central page. (Merritt believes the data to be reliable but does not make any representations as to its accuracy or completeness). In addition to the Merritt information related to the featured bond, more information can be found on our municipal bond calendar, city, state, and county pages, and our employment database. These facts and numbers are for informational purposes, and should not be considered an official disclosure for potential investors. Investors should consult the official statement. None of the information provided should be construed as a recommendation by MuniNet Guide, MuniNet LLC, Merritt Research Services LLC, or any of their employees. Information and analysis is for informational purposes only.

Provided at left is a quick snapshot of financial characteristics of the State of Tennessee, along with the state medians, courtesy of Merritt Research Services, LLC. Merritt has many of the sector medians publicly available and regularly updated on their Benchmark Central page. (Merritt believes the data to be reliable but does not make any representations as to its accuracy or completeness). In addition to the Merritt information related to the featured bond, more information can be found on our municipal bond calendar, city, state, and county pages, and our employment database. These facts and numbers are for informational purposes, and should not be considered an official disclosure for potential investors. Investors should consult the official statement. None of the information provided should be construed as a recommendation by MuniNet Guide, MuniNet LLC, Merritt Research Services LLC, or any of their employees. Information and analysis is for informational purposes only.