By James Spiotto

- What is Chapter 9?

- Exclusive chapter of the Bankruptcy Code that provides a method for municipalities to adjust debt.

- Not a tool for elimination of municipal debt but adjustment of debt to what is sustainable and affordable.

- It is voluntary, a municipality cannot be forced into bankruptcy.

- States as co-equal Sovereign with the Federal Government cannot use and file for a Chapter 9 bankruptcy.

- When has it been used?

- To adjust the level of debt obligations of a municipality so the debt is sustainable and affordable.

- To restructure burdensome labor contracts.

- To avoid or restructure legal settlements and judgments.

- Losses on or poor investment strategies.

- To restructure pension and health care related liabilities.

- To adjust the level of debt obligations of a municipality so the debt is sustainable and affordable.

- To restructure burdensome labor contracts.

- To avoid or restructure legal settlements and judgments.

- Losses on or poor investment strategies.

- To restructure pension and health care related liabilities.

- To restructure contractual obligations.

- To restructure debt on a failed enterprise or proprietary project.

- To restructure tax-exempt debt.

- To be used as a last resort when all other compromise and restructuring efforts fail to reduce debt obligations of municipalities so that essential governmental services can continue to be provided.

- Chapter 9 is not a tool for elimination of municipal debt:

- Since a municipal unit is intended to continue to provide governmental services in perpetuity and is not intended to liquidate its assets to satisfy creditors but rather continue to function as a municipality, the primary purpose of Chapter 9 is to allow the municipality to continue operating and keep creditors away while it adjusts or refinances creditor claims.

- Adjustment of the debts of a municipality is typically accomplished either by extending debt maturities, reducing the amount of principal or interest, or refinancing the debt by obtaining a new loan.

- More appropriate to refer to Chapter 9 as municipal debt adjustment rather than municipal bankruptcy.

- It is voluntary, a municipality cannot be forced into bankruptcy.

- Who is eligible to file Chapter 9 – only those municipalities that are specifically authorized by their State law can file:

- To be a debtor in a Chapter 9, an entity must be:

- An entity that is a municipality (political subdivision, public agency or instrumentality of State – States are a co-Sovereign with the Federal Government and cannot file for Chapter 9);

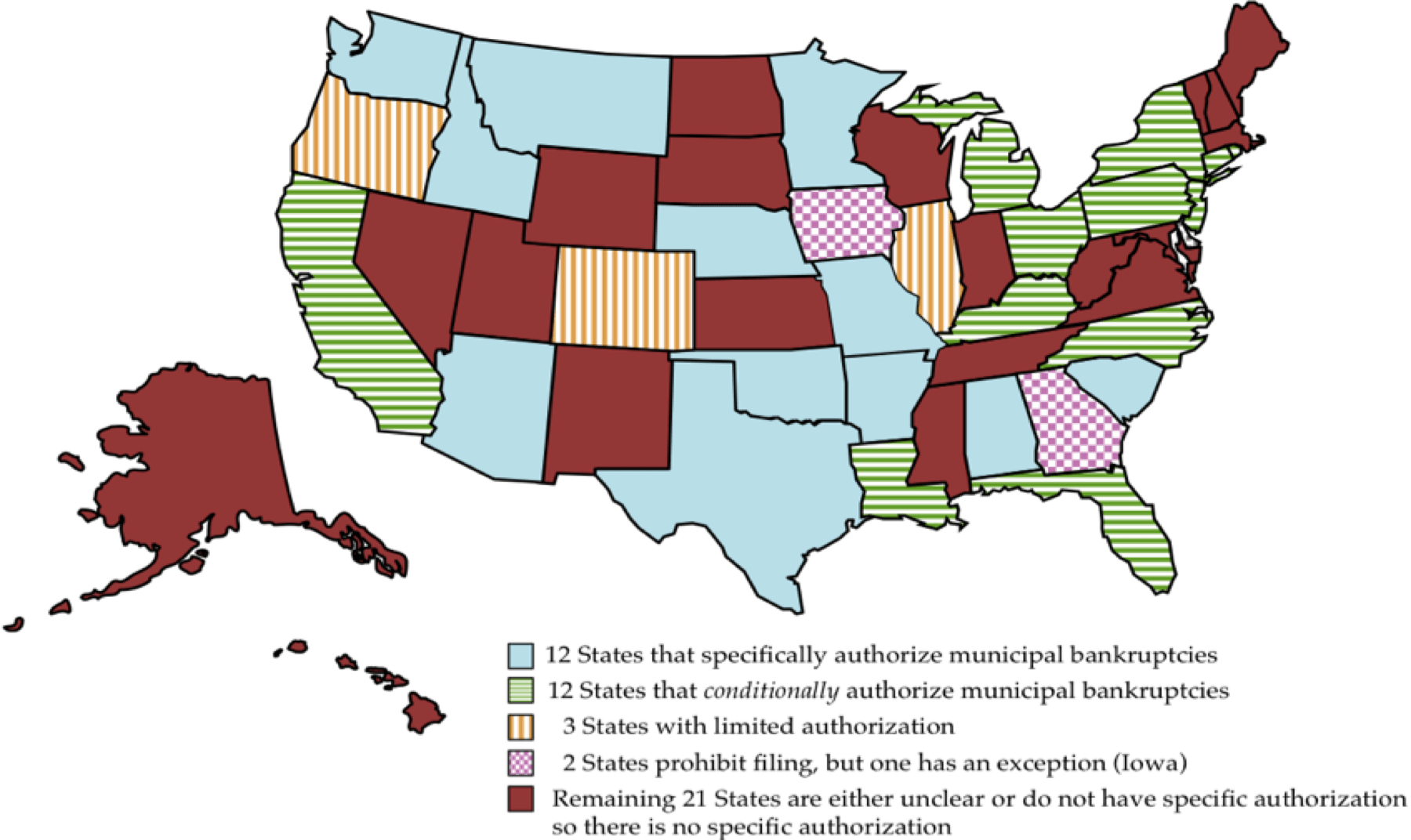

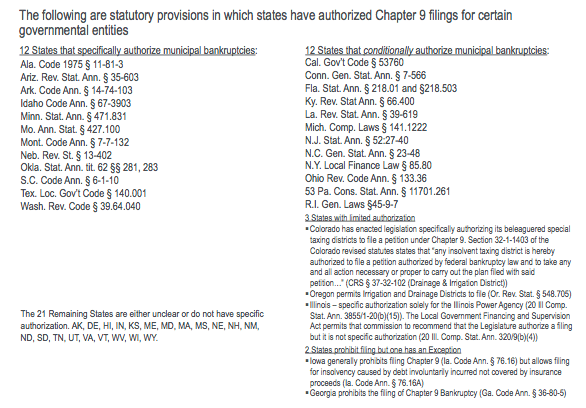

- Specifically authorized under State law to be a Debtor. Twelve States have Statutory Provisions in which the State specifically authorizes filing (AL, AZ, AR, ID, MN, MO, MT, NE, OK, SC, TX, WA), another twelve States authorize a filing conditioned on a further act of the State, an Elected Official or State entity or neutral evaluator (CA, CT, FL, KY, LA, MI, NJ, NC, NY, OH, PA, RI). Three states (CO, OR and IL) grant limited authorization, two states prohibit filing (GA) but one of them (IA) has an exception to the prohibition. The remaining 21 are either unclear or do not have specific authorization (California, one of the 12 states that conditionally authorized Chapter 9 by municipalities, has new legislation enacted on October 9, 2011, adding the requirement that, before being able to file Chapter 9, a municipality must first either (i) use a neutral evaluator or (ii) declare a fiscal emergency finding there is jeopardy to the health, safety or well being of its residents and it is unable to pay its obligations within the next 60 days);

- Insolvent:

- Proving insolvency can be challenging. As Municipality has to prove it is not paying its debts or is unable to pay its debts when they come

- Willing to effectuate a plan

- Obtain the agreement of creditors holding majority amount of the claim of each class that the municipality intends to impair or have attempted to negotiate in good faith, but was unable to do so or it was impractical to negotiate with creditors or a creditor is attempting to obtain a preference.

- To be a debtor in a Chapter 9, an entity must be:

- What is a municipality?

- Under 11 U.S.C. §101 (15):

- An “entity” includes a person, estate, trust, governmental unit, and United States Trustee.

- Under 11 U.S.C. §101 (27):

- An “governmental unit” means United States, State, Commonwealth, District, Territory, municipality, foreign state, department, agency, or instrumentality of the United States (but not a United States trustee while serving as a Trustee), a State, a Commonwealth, a District, a Territory, a municipality, or a foreign state or other foreign or domestic government.

- Under 11 U.S.C. §101 (40):

- A “municipality” means political subdivision or public agency or instrumentality of a state.

- Under 11 U.S.C. §101 (15):

- Interested parties in Chapter 9:

- The municipality.

- Bondholders or their trustees.

- Landowners and other tax payers.

- Unsecured (trade) creditors (unsecured creditors committee).

- The state.

- Unions.

- Judgment and other secured creditors.

- Issue:

- How are professionals paid for?

- Chapter 9 legal impact on trustees and holders of municipal debt:

- Creditors are subject to automatic stay upon filing of Chapter 9 petition.

- Automatic stay prohibits collection efforts by creditors or taking remedies to repossess or siege leased property.

- Automatic stay impacts holders of general obligation bonds or unsecured debt greater then in Chapter 11 because municipalities are afforded great freedom in the use of revenues and assets to perform their governmental functions.

- Bonds or obligations secured by special revenues are exempt from automatic stay (for a statutory lien a lift stay motion may have to be filed) but the tax revenue pledge to pay those bonds is not to be used for any other purpose or otherwise impaired.

- Bonds secured by statutory lien and special revenues are intended to have the lien on pledged tax revenue continue after the filing of a Chapter 9 unlike a corporate pre-petition lien on account receivables or inventory that is terminated as to property created after filing a Chapter 9.

- Preference in Chapter 9:

- The Municipal Bankruptcy Amendments not only address the problem of revenue bondholders, but actually provide assurance to holders of all municipal bond or note obligations. Section 926(b) of the Bankruptcy Code now provides that a transfer of property to the debtor to or for the benefit of any holder of a bond or note on account of such bond or note may not be avoided under Section 547. While this section refers to “bonds or notes,” there is nothing in the legislative history to support the view that this provision is limited only to instruments bearing such titles. The legislative intent appears to be that Section 926(b) should be applicable to all forms of municipal debt issued to investors.

- Limitation on the Bankruptcy Court jurisdiction:

- The Bankruptcy Court in a Chapter 9 proceeding cannot interfere with the revenue, government and political affairs of the municipality.

- Other than the lack of revenues to pay creditors, municipal services are provided and determined as to whether they will be provided by the governmental body, not by the Bankruptcy Judge. (See e.g.,Bankruptcy Court’s refusal to overturn the “Water Shut Off” ruling by the Detroit utility for nonpayment.)

- Unlike Chapter 11, the municipality can sell its assets, incur debt and engage in governmental affairs without necessarily having to obtain the approval of the Bankruptcy Court.

- Other issues in Chapter 9:

- Labor issues:

- Burdensome labor contracts can be rejected for cause (City of Vallejo, Detroit and San Bernardino).

- Unfunded pension liabilities are unsecured obligations and no priority for wages, vacation, pension or healthcare in Chapter 9.

- Non-bonded debt or contracts:

- No priority among unsecured claims unless they qualify as administrative.

- In a Chapter 9 proceedings, the municipality may assume or reject an executory contract or unexpired lease.

- Municipal lease financing presents issue of true vs. financing lease (United Airline Bankruptcy Litigation).

- Priming of bonded debt by:

- Necessary operating expenses.

- Priming of unsecured debt by:

- Administrative claims.

- Duration of Chapter 9:

- Long enough to accomplish objectives. In complicated actual city or county filing, measured in years.

- Labor issues:

- Emergence from Chapter 9:

- The Court must confirm a plan if all the requirements of §943(b) are satisfied:

- the plan complies with the provisions of this title made applicable by sections 103(e) and 901 of this title;

- the plan complies with the provisions of this chapter;

- all amounts to be paid by the debtor or any person for services or expenses in the case or incident to the plan have been fully disclosed and are reasonable;

- the debtor is not prohibited by law from taking any action necessary to carry out the plan;

- except to the extent that the holder of a particular claim has agreed to a different treatment of such claim, the plan provides that on the effective date of the plan each holder of a claim of a kind specified in section 507(a)(2) of this title will receive on account of such claim cash equal to the allowed amount of such claim;

- any regulatory or electoral approval necessary under applicable nonbankruptcy law in order to carry out any provision of the plan has been obtained, or such provision is expressly conditioned on such approval; and

- the plan is in the best interests of creditors and is feasible (which should be interpreted as being sustainable and affordable and providing sufficient funding for essential governmental services and infrastructure at an acceptable level).

- New obligations arise under the plan and pre-confirmation obligations are discharged in accordance with the plan, the order confirming the plan and §944(b).

- While the market typically views the filing for Chapter 9 as a substantial negative, if the filing is perceived to be the result of a problem that has been dealt with, as in Orange County, the market impact has not been permanent.

- The Court must confirm a plan if all the requirements of §943(b) are satisfied:

For more detailed analysis see Spiotto, J., “Primer on Municipal Debt Adjustment in Chapter 9: The Last Resort for Financially Distressed Municipalities.” Chapman and Cutler LLP, 2012.

James E. Spiotto, Co-Publisher © James E. Spiotto. All rights reserved (2015).