By James Spiotto

Myth: State and local governments only recourse to financial distress is to file bankruptcy or to stop making debt payments to bondholders.

Reality: States do not presently have a bankruptcy alternative and do not seem to desire one.

State and local governments have numerous resolution alternatives for financial distress such as use of receiver or financial oversight, refinancing or control boards and commission to supervises corrective actions, refunding, transfer services to another government entity to reduce costs, budget cuts, increase in tax revenues, loans and grants from the state, use of intercepts to dedicate payment to those costs that must be paid and other options.

State and Local Governments Have a History of Addressing and Solving Financial Distressed Situations

- Refinancing and bridging financial distress. If a particular state does not allow its municipalities to file a chapter 9 petition, the state may, through an Intergovernmental Cooperation Act or Refinancing Authority, step in and provide:

(a) bridge financing or refinancing of the troubled debt;

(b) transfer certain services to other governmental agencies to reduce expenditures;

(c) grant funds to the municipality to bridge the financial crisis;

(d) loan funds to the municipality on terms that are realistic or payable out of state tax sources that can be offset; and/or

(e) use intercept of state tax payable to the municipality to ensure essential municipal services. A particular state’s action will depend on the authority provided in the state’s statutes, whether bridge financing or refinancing of troubled debt.

- Receivers and dissolving local government. The state courts may also be used to appoint a receiver to supervise the municipality’s board. Along with this, a court of equity or legislature could withdraw the municipality’s charter and liquidate its assets to distribute to creditors. This, of course, is the least politically acceptable resolution and would be a highly unlikely scenario. In any of these scenarios, a lender should enter the negotiations early to better protect its interests.

- The general approach to distress. Generally, Refinancing Authorities, Receiverships and Commissions do not deal with adjustment of debt but rather with providing funds for continued provision of municipal services (gratis or loans), refocusing municipal services to other governmental bodies and requiring a balanced budget going forward.

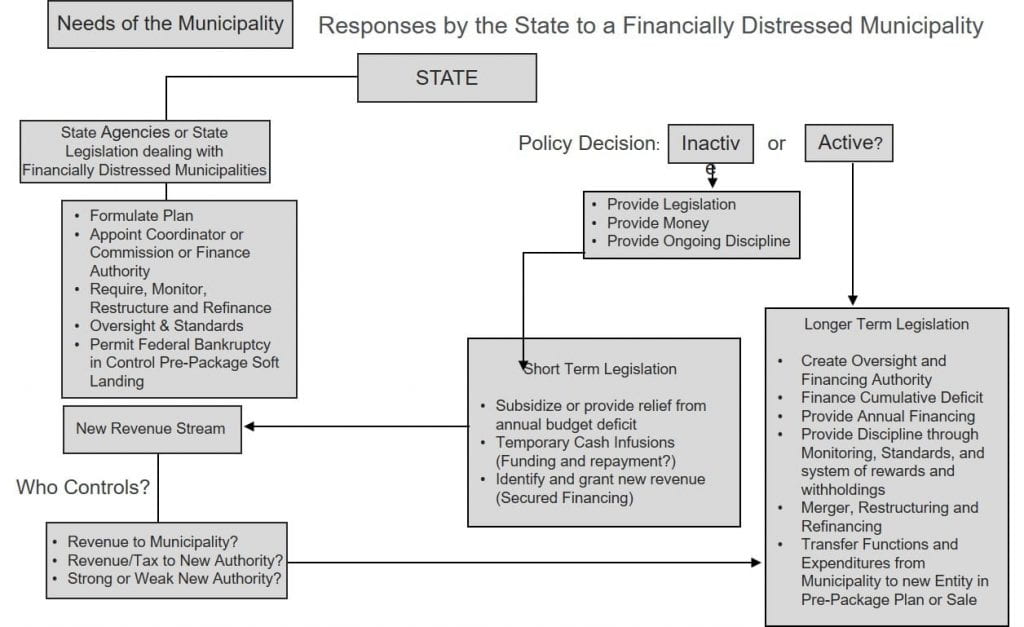

- What states can do. The State may, by state statute (Intergovernmental Cooperation Act or Refinance Authority), step in and provide:

- Bridge financing or refinancing of troubled debt.

- Transfer certain services to other governmental agencies to reduce expenditures.

- Grant funds to the municipality to bridge the financial crisis.

- Loan funds to the municipality on terms that are realistic or payable out-of-state tax sources that can be offset.

- Use intercept of State tax payable to municipality to ensure essential municipal service.

- What refinance and supervision can do. Use of State Finance or Supervisory Board to provide Adult Supervision (such as Municipal Assistance Corporation for NYC in 1975, Chicago School Finance Authority 1978):

- Require Balanced Budgets, provide economic discipline and reporting.

- Issue debt in state name or separate entity to obtain market credibility and access.

- Power to negotiate debt restructuring and quasi-judicial jurisdiction.

- Review services or costs that can be transferred to other governmental bodies.

- Right to intercept tax revenue and focus use on essential services and cost.

- Power to authorize Chapter 9 if needed.

- Monitor compliance with any restructuring plan.

- Pennsylvania Act 47 Financially Distressed Municipalities Act. Twenty-five municipalities have been declared financially distressed since 1988 and only six have had the designation rescinded.

- New York has Financial Control Boards.

- Connecticut has a Commission to supervise balanced budget and financial status.

- Ohio has a Local Fiscal Emergencies Act to deal with budget and accounting issues.

- Use of state or court appointed receivers:

- Provide Adult Supervision as Board.

- Municipal receiverships go back to Fifth Century B.C. and the Greek town of Atarneus where a Greek banker took over administration due to a defaulted loan.

- Use of Court of Equity or legislature to withdraw charter of the municipal entity and liquidate assets and distribute to creditors.

- Unlike a corporation, it is very hard to liquidate a municipality or state and the least politically acceptable resolution.

See Spiotto, James E., The Role of the State in Supervising and Assisting Municipalities Especially in Times of Financial Distress, Municipal Finance Journal, Vol. 33, No. 4, Vol. 34, No. 1, Winter/Spring 2013, Part 1 and 2.

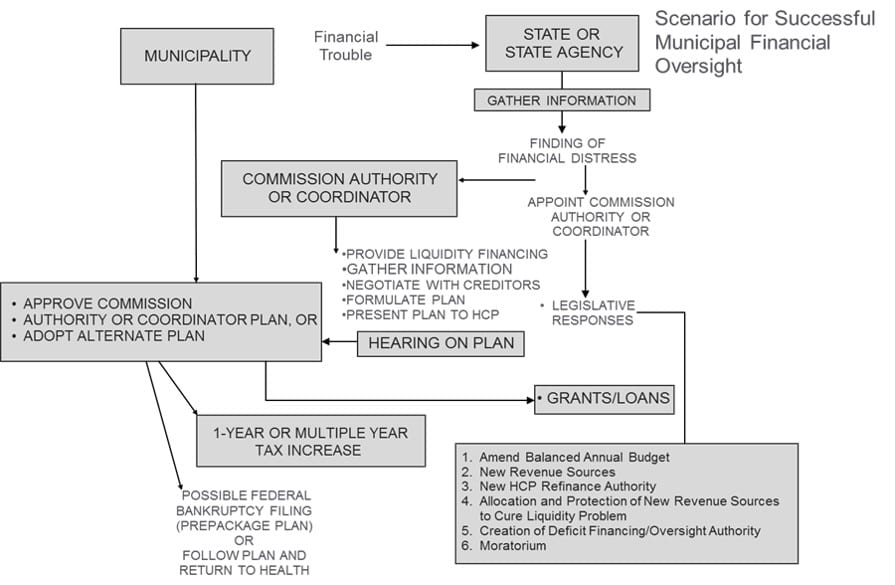

The Structure for Oversight and Emergency Financing

- Local governmental bodies experiencing financial distress often times are resolved by the resort to state created financing and oversight authorities with various degrees of formal oversight and control.

- Creation of a commission which later develops into a refinancing authority provides two basic advantages:

- The new authority has financial credibility and access to capital markets if it has an assured source of revenue to pay debt service which is isolated from bankruptcy and other credit risk.

- An independent authority can use a variety of fiscal tools to enforce fiscal discipline on the local government because it is removed from political pressure.

Scorecard for Other Mechanisms for State to Address Financial Distress of Its Local Governments

Virtually all States have some statutes providing for:

- Ability to refund. (All states have some provision for Refunding Bonds.)

- Debt limitations (at least 49 have some form of debt limitation).

- Appointment of receivers (at least 43 states).

- Mandamus or remedies upon default to require payment of debt or levying taxes. (All 50 states have mandamus and at least 28 states have some provision for foreclosure, 23 states provide for a statutory right to such an accounting and at least 18 states have other remedies.)

- Statutory liens or special revenues. (All 50 states have some form of special revenue and at least 30 states have statutory liens.)

Active financial supervision or financial review (over half of the States):

At least 2 – Debt Advisory Commission.

At least 8 – Statutes providing for debt compromise or adjustment process and intercepts for payment.

At least 15 – Active technical assistance, grants, loans, budget review.

At least 17 – Financial control boards, refinance authorities and active outside supervision and review.

Virtually every state has some form of limitation on taxes or debt or a combination of both.

Selected Case Studies

New York City – 1975

- Questionable Accounting Practices for 10 years prior to 1975.

- Lack of Funds to meet short-term Debt Obligations.

- Federal and State Bridge Financing.

- State Municipal Assistance Corporation.

Cleveland, Ohio – 1978

- Default on $15.5 million of Board Anticipation Notes.

- Large General Fund Deficit.

- Then current Bankruptcy Legislation increased concerns with respect to Bailout Financing.

- Amended Bankruptcy Code in 1988 to allow Special Revenue Financing protected from subsequent Bankruptcy Filing.

- State Bailout.

San Jose School District – California (1983)

Teacher Union Contract Dispute:

- Reduced Real Estate Tax Revenue.

- First major municipality to file for Bankruptcy since the Great Depression.

- Paid Interest to Bondholders During Bankruptcy.

- Ultimately settled with Teachers and Dismissed Bankruptcy.

- Unlimited Tax G.O. Bond – pay during Chapter 9 bankruptcy on time and without any impairment.

Medley, Florida (1968)

- Small city of 350 residents.

- Filed for Bankruptcy Protection but promised to pay.

- Bondholders before other creditors.

Washington Public Power Supply System (WPPSS) – 1983

- Projected Demand for electric power in Pacific Northwest of U.S.A. did not materialize.

- Financing of Nuclear Power Plants 4 and 5 for $2.25 billion had both legal and feasibility problems.

- Supreme Court of State of Washington holds Municipal Participants not obligated to pay – (6/15/83).

- Legal and Financial meltdown.

- Issue of lingering legal problem – need for clear, objective and validated statutory basis for financing.

- Necessity of legal validation.

The Colorado Special Districts

- Financing for infrastructure for Real Estate Developments – streets, sewers, utilities and the like.

- Over-Development and Lack of Demand.

- Wrong Economics – lack of feasibility.

- Municipal Debt Adjustment – Chapter 9 proceedings.

City of Bridgeport, Connecticut – 1991

- Financial distress of City due to business and residents leaving core city and reducing the tax base.

- State of Connecticut enacted special legislation to discipline financing and limit expenditures to actual revenue.

- Mayor disputes State’s effort and contests budget restraints files for Bankruptcy – Municipal Debt Adjustment.

- City elects new Mayor and works with State as Bankruptcy is dismissed on technical reason.

- Balanced budget enforced by State.

City of Philadelphia – 1991 – (Model Legislation for Emergency Financing) — Long Term

Operating Deficit of $200 million:

- Refinancing and Bridge Financing as well as restructuring of operation and responsibilities.

- Statutory Authority for Emergency Financing and Restructuring:

- State Authority.

- Membership on Authority Board – representative.

- Compliance with Constitution Provision:

- Ability to tax.

- Ability to direct and oversight.

- Ability to fund.

- Use of Intergovernmental Agreements and transfer of Service Obligation.

- Refunding of Past Obligations.

- Development of near Term and 5 year.

Financial Recovery Plan:

- Budget Development, Review and Approval.

- Collective Bargaining Agreement Review and Approval.

- Limit Availability of Federal Bankruptcy.

- Create New Revenue Sources.

- Intercept of State Revenue to City for Proper Disposition.

City of Central Falls, Rhode Island – 2011

- In 2010, Central Falls, a financially troubled Rhode Island town, sought a court-appointed receiver under the then-existing law.

- A judge appointed an outside lawyer as temporary receiver and gave him oversight over the town’s finances, including vendor contracts.

- State officials and others worried the move could have a ripple effect beyond Central Falls disrupting the municipal bond market and alarming rating agencies.

- As a result, a new bill was enacted that prohibits cities and towns in Rhode Island from entering judicial receivership and that calls on the State to intervene earlier when communities are in financial trouble.

- The new law introduces levels of state oversight for struggling municipalities.

- The first level allows the state director of revenue to appoint a fiscal overseer for communities in financial distress.

- The overseer would have the authority to review all proposed contracts, approve the annual budget and supervise expenditures. If the town is still unable to produce a balanced budget, the law authorizes the creation of a budget commission.

- And if problems still persist, the state can appoint a receiver, who besides having oversight of the city or town has authority to file for federal bankruptcy protection.

- The bill was written to apply retroactively so as to cover Central Falls.

- In May 2011, the Rhode Island Senate approved (May 26, 2011) legislation and on July 2, 2011 the governor signed into law the legislation that required municipalities to guarantee lenders and holders of bonds and notes the first lien right to property taxes (ad valorem) and general revenues in the event of a bankruptcy or financial distress – an effort to improve the ability of Rhode Island municipalities to borrow money in challenging financial markets.

- Later in 2011, Central Falls filed for Chapter 90 municipal bankruptcy but the negative contagion of the filing was mitigated by giving the statutory lien to bonds and notes so access and cost of borrowing for other municipalities was not impaired.

- Central Falls Chapter 9 bankruptcy in 2011 that lasted about 13 months was claimed to be one of the most expeditious because of the state law granting the first lien to note and bondholders and the new Oversight-Receiver Law.

James E. Spiotto, Co-Publisher © James E. Spiotto. All rights reserved (2015).